Managing finances efficiently is crucial for individuals and businesses alike. An income & expense template 2025 simplifies this process by providing a structured format to track earnings and expenditures. With a well-designed income expense sheet, users can categorize transactions, analyze spending habits, and make informed financial decisions. Whether using an income expenses spreadsheet or an income and expense Excel template 2025, having a clear financial overview can lead to better budgeting, forecasting, and savings in 2025. In this article, we explore the significance of these templates, real-world case studies, and how they can transform financial planning.

Financial Mismanagement and Overspending:

Financial mismanagement is a common problem faced by both individuals and businesses. Without a clear system in place, tracking income and expenses becomes chaotic, leading to poor financial decisions. Some common issues include:

- Overspending without realizing it

- Difficulty in budgeting and forecasting

- Lack of financial insights for growth planning

- Missing tax deductions due to unorganized records

Without a proper income & expense template 2025, businesses may struggle with cash flow issues, while individuals might find it hard to save or invest wisely.

The Cost of Not Keeping Track:

Imagine running a small business where you don’t track daily expenses. At the end of the year, you suddenly realize you’ve spent more than you earned. This scenario isn’t uncommon. A real-life case study from a freelance consultant in 2024 showed how inconsistent expense tracking led to a $10,000 shortfall by year-end. Similarly, a restaurant owner who failed to track supplier costs had to shut down due to unexpected financial miscalculations.

For individuals, the impact is equally alarming. According to a 2024 survey, 60% of Americans admitted they don’t track daily expenses, leading to unnecessary debt and reduced savings. In a time when inflation is rising, having an income expense sheet isn’t just helpful—it’s essential.

Related Article: meeting minutes template

Using an Income & Expense Template for Financial Clarity:

The best way to avoid financial pitfalls is by using a structured income expenses spreadsheet. This simple yet powerful tool allows users to:

- Track every dollar earned and spent

- Categorize expenses for better analysis

- Identify areas to cut costs

- Plan future expenses based on trends

- Improve financial decision-making

Key Features:

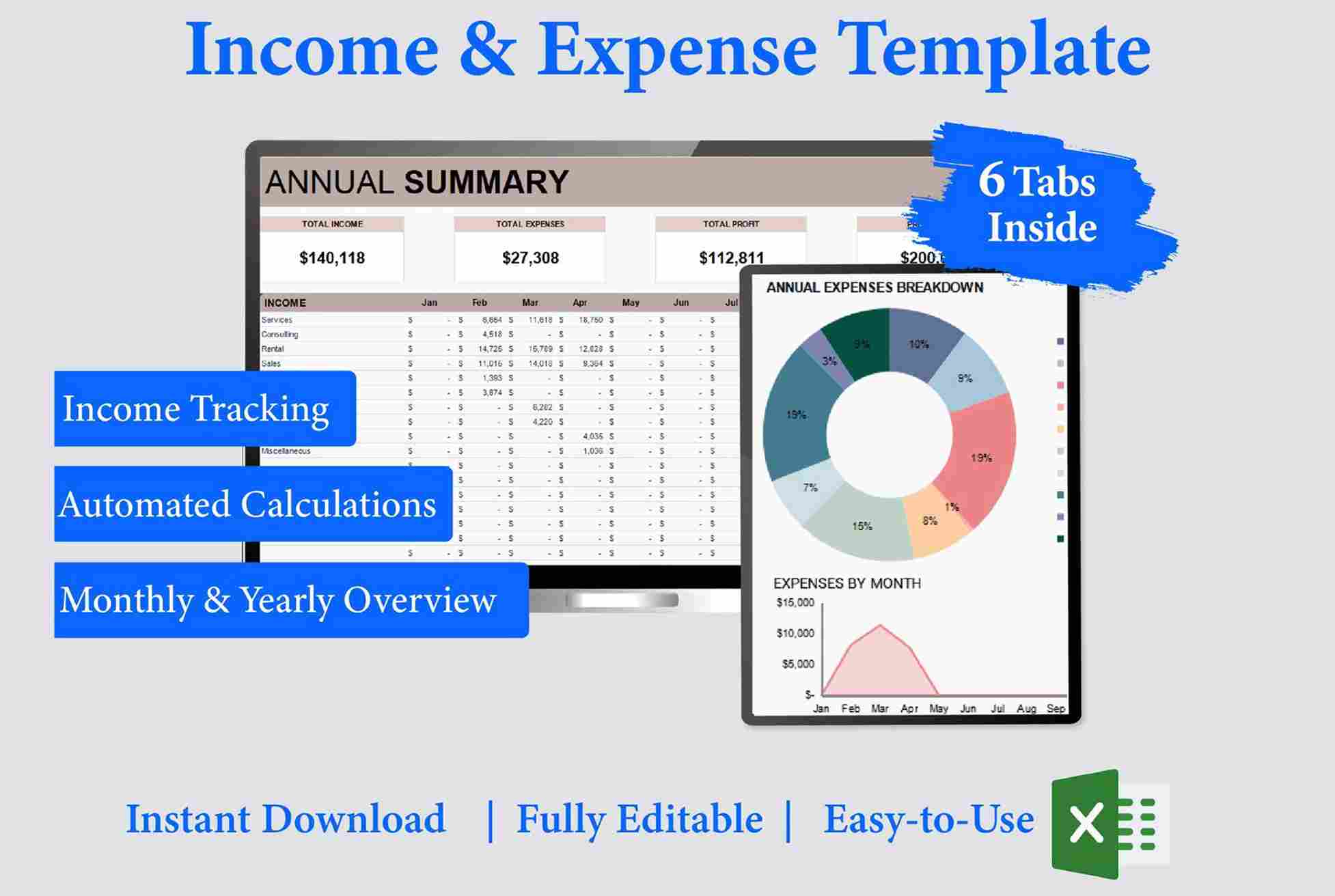

A well-designed income and expense Excel template should include the following:

- Income Tracking: Record different sources of income such as salary, business revenue, freelance earnings, or passive income.

- Expense Categorization: Break down expenses into rent, utilities, groceries, entertainment, business supplies, and other relevant categories.

- Automated Calculations: Summarize totals, balances, and comparisons without manual work.

- Visual Reports: Charts and graphs to help analyze spending patterns.

- Budgeting Section: Set financial goals and compare them against actual spending.

- Tax Preparation: Simplify tax filing by maintaining a clear financial record.

Key Components:

A well-designed income and expense Excel template should include the following:

- Income Tracking: Record different sources of income such as salary, business revenue, freelance earnings, or passive income.

- Expense Categorization: Break down expenses into rent, utilities, groceries, entertainment, business supplies, and other relevant categories.

- Automated Calculations: Summarize totals, balances, and comparisons without manual work.

- Visual Reports: Charts and graphs to help analyze spending patterns.

- Budgeting Section: Set financial goals and compare them against actual spending.

- Tax Preparation: Simplify tax filing by maintaining a clear financial record.

Related Article: capability statement template

Benefits:

- Financial Clarity: Provides a clear picture of earnings and expenditures.

- Better Budgeting: Helps set and maintain financial goals.

- Informed Decision-Making: Identifies trends and areas to save money.

- Time-Saving: Reduces the need for manual tracking and calculations.

- Improved Cash Flow Management: Ensures businesses maintain a positive cash flow.

- Simplified Tax Filing: Keeps financial records organized for easy reporting.

- Reduction of Unnecessary Expenses: Highlights areas where costs can be cut.

- Increased Savings: Helps individuals and businesses allocate funds more effectively.

Best Practices:

- Choose a Suitable Format: Whether using an income and expense Excel template, Google Sheets, or an accounting app, pick a format that suits your needs.

- Customize Categories: Modify the template to align with personal or business financial goals.

- Record Transactions Daily: Consistent tracking leads to accurate insights.

- Review and Adjust Monthly: Analyze spending trends and make necessary adjustments.

- Leverage Automation: Use formulas or financial software to streamline calculations and reporting.

- Backup Data Regularly: Ensure financial records are not lost due to technical failures.

- Analyze Trends Quarterly: Compare financial performance over different periods to improve financial planning.

- Set Financial Goals: Use past data to forecast and plan for future expenses and savings.

Related Article: employee schedule template

Case Study: How a Small Business Saved 20% on Costs

A marketing agency implemented an income & expense template in early 2024 after realizing they had no proper financial tracking system. By categorizing expenses and regularly reviewing reports, they identified unnecessary subscriptions and optimized their budget. Within six months, they reduced overhead costs by 20% and improved profit margins.

Similarly, an e-commerce seller used an income expenses spreadsheet to track advertising spend versus revenue. This helped them allocate their budget efficiently, doubling their ROI within a year.

How to Get Started with an Income & Expense within budget Template in 2025:

- Choose a Suitable Format: Whether using an income and expense Excel template 2025, Google Sheets, or an accounting app, pick a format that suits your needs.

- Customize Categories: Modify the template to align with personal or business financial goals.

- Record Transactions Daily: Consistent tracking leads to accurate insights.

- Review and Adjust Monthly: Analyze spending trends and make necessary adjustments.

- Leverage Automation: Use formulas or financial software to streamline calculations and reporting.

Related Article: project communication plan template

Why 2025 is the Year to Prioritize Financial Tracking:

With rising inflation, changing tax laws, and unpredictable market conditions, financial planning is more critical than ever. Using an income & expense template is not just about organization—it’s about financial empowerment. Whether you’re an entrepreneur, a freelancer, or a household manager, having a structured approach to money management can lead to better financial health and long-term success.

Personal Experience:

Personally, I’ve been using an income & expense template for over a year, and it has transformed the way I manage my finances. Before, I struggled to keep track of business expenses, often underestimating costs. But once I started using a structured income expense sheet, I gained clear visibility into my cash flow.

This tool has helped me cut down unnecessary spending, optimize my monthly budget, and prepare better for tax season. The best part is the automation—no more manual calculations! Whether you’re running a business or managing household finances, I highly recommend using an income and expense Excel template to stay on top of your financial goals.

Final Thoughts:

In 2025, financial stability begins with clarity and control over money matters. A well-structured income expense sheet can make a difference between financial success and stress. By leveraging an income expenses spreadsheet, users can gain insights, cut unnecessary costs, and plan for the future with confidence. Start tracking your finances today and take control of your financial future!

Related Article: Financial management

FAQS:

1. How does an income expense sheet help with budgeting?

A income expense sheet categorizes income and expenses, making it easier to track spending habits, reduce unnecessary costs, and set financial goals.

2. Can I use an income and expense Excel template for my business?

Yes, an income and expense Excel template is ideal for businesses, freelancers, and individuals looking to organize their finances effectively.